However, the Ratio is just barely above the threshold of 1.0, which is generally considered safe for most industries. This indicates a need for Reliance to continue monitoring and potentially improving its short-term debt management. There are more current liabilities than cash and cash equivalents when a company’s cash ratio is less than one.

What Happens If Ratios Show a Firm Is Not Liquid?

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. Credit institutions shall not take into account inflows from any new obligations entered into.

Salvage Value – A Complete Guide for Businesses

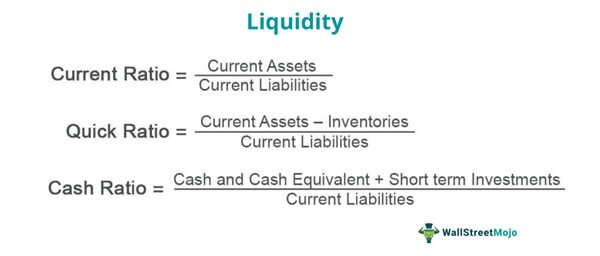

The quick ratio suggests an even less liquid position, with only $0.20 of liquid assets for every $1 of current liabilities. By way of derogation from the first subparagraph, where the counterparty to the secured lending or capital market-driven transaction is the domestic central bank of the credit institution, the outflow rate shall be 0%. The current iobit start menu 8 for windows 8 free download ratio measures a company’s ability to pay its short-term liabilities using its short-term assets. A ratio above 1 indicates that the company has enough assets to cover its liabilities, while a ratio below 1 suggests potential liquidity issues. A company’s cash ratio is calculated by dividing its cash and cash equivalents by its short-term liabilities.

Article 4 The Liquidity Coverage Ratio

For a firm, this will often include being able to repay interest and principal on debts (such as bonds) or long-term leases. Let’s use a couple of these liquidity ratios to demonstrate their effectiveness in assessing a company’s financial condition. For instance, a capital-intensive industry like construction may have a much different operational structure than that of a service industry like consulting.

Article 25 Outflows from Other Retail Deposits

- There are three main indicators of liquidity – absolute liquidity, urgent liquidity, and current liquidity.

- This is because the company can pledge some assets if it is required to raise cash to tide over the liquidity squeeze.

- Credit institutions shall have policies and limits in place to ensure that the holdings of liquid assets comprising their liquidity buffer remain appropriately diversified at all times.

- Let’s use a couple of these liquidity ratios to demonstrate their effectiveness in assessing a company’s financial condition.

- And a cash ratio below 1 is not necessarily bad news—especially if the firm has short credit terms with clients, efficient inventory management, and a short net trade cycle.

Current assets include cash, short-term investments, accounts receivable, inventories, and prepaid expenses. Non-current assets include non-current investments and long-term receivables. Together, these various ratios provide a more complete picture of a company’s financial position and operating performance when evaluating its stock as an investment. Using a mix of liquidity, profitability, leverage, operating, and valuation ratios allows investors to thoroughly analyze a company from multiple angles. These high-risk companies become entirely dependent on selling assets or taking on new debt to generate liquidity as their revenues fail to sufficiently cover short-term obligations.

What Is the Cash Ratio?

This all-in-one solution allows you to track invoices, expenses, and view all your financial documents from one central location. The higher the number, the better because it indicates that the company has enough cushion to pay off its short-term obligations if necessary. For example, suppose a company has an EBIT of Rs.1 million, and its quarterly interest expense is Rs.200,000; its time’s interest earned Ratio would be as given below. The “ideal” Liquidity Ratio is highly dependent on the industry and type of business. With that said, from a liquidity standpoint, a negative NWC is preferred over a positive NWC. As for inventory, finding interested buyers can require steep discounts, so the sale price is often lower than the value as stated on the books (or could even remain unsold).

These ratios offer a quick snapshot of a company’s liquidity position without delving into complex financial analysis. For instance, the current ratio, which divides current assets by current liabilities, can quickly be determined by glancing at a company’s balance sheet. With liquidity ratios, current liabilities are most often compared to liquid assets to evaluate the ability to cover short-term debts and obligations in case of an emergency. The cash ratio is generally a more conservative look at a company’s ability to cover its debts and obligations compared to other liquidity ratios. It sticks strictly to cash or cash-equivalent holdings, leaving other assets such as accounts receivable out of the equation. This ratio provides the most comprehensive assessment of a company’s ability to cover short-term obligations with its liquid assets.

However, poor liquidity forewarns of cash flow challenges that constrain activities that benefit shareholders, like dividends, buybacks, acquisitions, and new products. Liquidity ratios measure businesses’ ability to cover short-term debt timely and without losses. In other words, it reveals how often a firm’s current assets—easily converted into cash—can cover its current liabilities, i.e., financial obligations due within a year. These are very useful ratios for calculating a company’s ability to pay short term liabilities. Relative liquidity is metric that measures a company’s ability to pay near term expenses. Both of them measure a company’s ability to use cash flow or asset’s to satisfy short-term liabilities that may arise in near future.

Last, liquidity ratios may vary significantly across industries and business models. Though we listed ‘comparability’ under the pro section, there is also a risk that wrong decisions could be made when comparing different liquidity ratios. An institution which uses liquid assets in a currency other than pounds Sterling to cover liquidity needs in pounds Sterling shall apply a haircut of 8% to the value of those assets in addition to any haircut applied in accordance with Article 418 of CRR.

An organization with a lower degree of relative liquidity will have difficulty fulfilling its debt obligations in a timely manner. Companies with low relative liquidity might face long-term financial issues. A liquidity ratio below 1.0 means a company’s current liabilities exceed its current assets. This indicates the company is not able to readily convert assets into cash in order to pay off pressing short-term bills and debts. The lower the Ratio, the greater the risk that the company could default on obligations, declare bankruptcy or experience severe disruptions to its operations from insufficient cash flow.

By not accounting for these near-term liabilities, the liquidity ratio underestimates true liquidity risk. The quick ratio for the year was 0.68, which remains a concern as it highlights the potential difficulty in settling immediate obligations without selling other current assets. This reinforces the need for Reliance to bolster its immediate liquidity reserves. The cash ratio was recorded at 0.82, showing a positive improvement over previous years. However, it is still not ideal, and Reliance should consider strategies to build up its readily available cash further. This means the company covers 87.5% of its short-term liabilities with its most liquid assets.